Explore the realm of coin collecting and gold investment with the 2024 King Charles III Britannia One Ounce Gold Coin. Discover its significance and captivating design in this blog. Join us as we delve into the details and uncover why this coin is a valuable addition to your investment collection.

The Significance of the Britannia Coin

The Britannia Coin’s significance stems from its Roman-era roots, symbolizing the British Isles. In modern times, it seamlessly blends tradition and modernity, appealing to collectors and investors. Featuring Britannia’s image, it honors heritage while fitting contemporary tastes. This dual appeal attracts history enthusiasts and investors, making it a cherished portfolio addition and a part of British heritage

Design Excellence

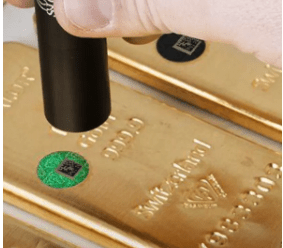

The 2024 King Charles III Britannia Gold Coin showcases a stunning design that pays homage to the enduring spirit of Britannia. On the obverse, you’ll find a portrait of King Charles III as seen here:

The reverse of the coin features the iconic image of Britannia herself. Her unwavering gaze and powerful stance symbolize the strength and resilience of the British nation.

Investment Value

Investing in gold coins, especially the Britannia coin, offers a valuable opportunity. These coins have a rich history and modern appeal, attracting collectors and investors. Their enduring design, featuring Britannia, blends tradition with the present, making them a wise choice. The dual appeal appeals to both history enthusiasts and investors, making them a treasured addition to portfolios and a part of British heritage.

Why Choose J. Blundell & Sons

At J. Blundell & Sons, we understand the significance of selecting the right coins for your investment portfolio. With a legacy of trust and expertise, we offer guidance and access to various precious metal investments, including the 2024 King Charles III Britannia Gold Coin. Explore the possibilities, make informed investments, and experience the timeless allure of Britannia. Visit our store in London Hatton Gardens or browse through our extensive gold bullion collection online today.