The recent declaration of a UK economic recession has triggered a notable response in the investment sphere, notably reflecting in The Royal Mint’s report of a significant 22% uptick in daily gold sales last Thursday 15th February 2024.. This sheds light on a substantial shift in investor sentiment.

Market Insights Analyst Commentary

Offering insights, Market Insights Analyst Stuart O’Reilly from The Royal Mint pointed out that the news of the UK recession prompted investors to reassess strategies, leading many to turn to gold as a steadfast safe-haven for preserving wealth. The impending impact on interest rates and inflation fuelled renewed interest in gold, potentially affecting central banks’ monetary policies.

Factors Driving Gold Demand:

O’Reilly underscored several factors behind the surge in gold demand. The possibility of lower interest rates, often viewed favourably for gold, became a significant consideration for investors. Gold’s historical resilience during recessions and economic uncertainty further contributed to the surge. Additionally, geopolitical risks, signs of banking sector turmoil in the US and China, and the potential for central bank gold buying all played roles in driving up demand.

Investor Trends and Tax Considerations:

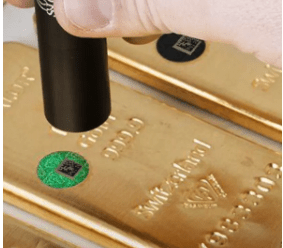

Data from The Royal Mint revealed a trend where investors are turning to gold and precious metals to diversify portfolios and hedge against risks. Notably, Sovereign and Britannia gold bullion coin and bar investment products emerged as preferred choices among investors. An interesting aspect highlighted is that these bullion coins are Capital Gains Tax-exempt for UK residents, providing a unique advantage for investors seeking tax efficiency amid market fluctuations.

Conclusion:

The recent surge in gold demand, as evidenced by The Royal Mint’s data, depicts investors actively seeking stability in uncertain times. Gold’s enduring appeal as a safe-haven asset is once again underscored as economic conditions prompt a re-evaluation of investment strategies. As the landscape evolves, the precious metal market may continue to be a focal point for investors navigating the complexities of a recessionary environment.

Discover the vast range of gold bullion made easy at jblundells.co.uk. As a trusted and credible gold dealer, we pride ourselves on offering an exceptional customer service and the highest quality of LMBA-approved gold bars and gold coins.