One of the frequent questions we get asked is which gold bar should a customer buy? Well, it really depends on your investment budget and individual needs. However, usually people are looking to invest in gold over a longer term than bitcoin or shares or safeguard against inflation and such, what that means is you don’t want a temptation to sell gold too early or get locked into selling a kilo bar worth £40-£50k to release say, just £5k worth of cash!

If you have a investment budget of say £40- £50k you could easily buy 1KG bar, however it might be good to buy a 500gm bar that you wouldn’t easily be tempted to sell and buy a 250gm with 2X100gm and a 50gm bar. Tip is to diversify in terms of weight, so if you have a short term cash deficit then you don’t have to break a big bar of 1kg, you could just sell a 100gm or 250gm bar to get through a short term situation.

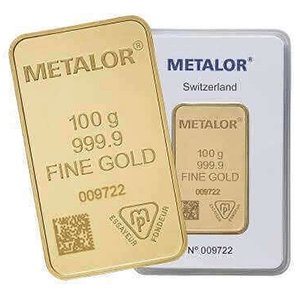

You could buy 10X100gm bars, however there smaller the bar more it costs per gram and also it could make it a little too convenient to sell something that you wanted to keep over a longer term. Again it depends on what your individual needs are, there are plenty of customers who choose this option as well and they do get a volume discount when bulk buying.

Another option is to get a secured loan against a gold bar, you should get 70% to 80% LTV ratio and may be the interest spent is worth not loosing an investment asset. J blundell and Sons offers both, we buy your gold and we give out loans against gold, please check out the ‘Borrow’ which covers loans in detail.

Hope this was helpful.

Advice above is generic and you should consult a financial advisor who can advise you about your individual needs.

1kg gold bar best value LBMA Approved

100gm gold bar best value LBMA Approved